Earlier this week, I stirred quite the hornet's nest with a silverogosphere allegory about Dave the Dung Beetle, which focussed on the themes of evidence, faith, responsibility and accountability. Warren followed up with some thoughts on being both right and wrong at the same time. So it falls now to me to try to complete the trilogy with a look at 'good' and 'evil'.

Good versus Evil

Earlier this week, I stirred quite the hornet's nest with a silverogosphere allegory about Dave the Dung Beetle, which focussed on the themes of evidence, faith, responsibility and accountability. Warren followed up with some thoughts on being both right and wrong at the same time. So it falls now to me to try to complete the trilogy with a look at 'good' and 'evil'.

Labels:

Bernanke,

Blythe,

EV-9D9,

Evil,

Godwin's Law,

Good,

silverogosphere,

Sith,

Turd

on being Right and Wrong at the same time

Just for the record, we really do like Turd Ferguson. Most authors here at Screwtape Files University have followed him from the very start over at the old blogspot, and even before that in the comments section at Zero Hedge and also donated (yep). We admire him for his persistence, concern and zeal, but we do have an overall concern that he's being led astray by his sources (and taking many with him) without a proper framework of accountability and research in place.

With the launch of his new paywalled website, couldn't help but noticing the concern some turdites had over the non-secure state of the website. A few commenters wanting to pony up their credit card details noticed there was no encryption on the new site, but Turd had 'talked with his tech people' and announced that there was nothing wrong with the security and that the digital certificate was working [link].

Since this is my area of expertise, I thought I would take a look. Basically Turd is Right and Wrong at the same time - this is normal in the world of technology, where many layers of complexity exist.

With the launch of his new paywalled website, couldn't help but noticing the concern some turdites had over the non-secure state of the website. A few commenters wanting to pony up their credit card details noticed there was no encryption on the new site, but Turd had 'talked with his tech people' and announced that there was nothing wrong with the security and that the digital certificate was working [link].

Since this is my area of expertise, I thought I would take a look. Basically Turd is Right and Wrong at the same time - this is normal in the world of technology, where many layers of complexity exist.

Dave the Dung Beetle

Dave was a hard-working little dung beetle, to be sure. He thought of no better life than rolling dung every morning, with no particular sense as to why, and then bringing it home to his store where he and his adoring family gazed upon the slowly increasing stash of excrement.

Not for Dave the spendthrift antics of his neighbours, Dwayne, Debbie and Dmitri, who think nothing of just eating what they roll in a day, or - worse! - borrowing dung from other beetles using their own future labour or houses as security. No, our Dave is a dung saver, and he is proud of his hard work to secure his family's future.

But, alas, dung beetle life is no fairer than that in many other spheres, and four years ago a great event occurred in which (for reasons they never entirely understood) large swathes of the dung beetle population lost their access to dung-rolling opportunities and therefore faced ruin. One might imagine that the value of Dave's dungpile would thus have increased, but in fact the opposite occurred. In order to save the population, the king dung beetle arranged for some cows to drop more pats all around the field. There was suddenly free dung for everyone, and Dave watched in horror as his little stash started to erode in worth compared to that of all the other dung beetles.

Not for Dave the spendthrift antics of his neighbours, Dwayne, Debbie and Dmitri, who think nothing of just eating what they roll in a day, or - worse! - borrowing dung from other beetles using their own future labour or houses as security. No, our Dave is a dung saver, and he is proud of his hard work to secure his family's future.

But, alas, dung beetle life is no fairer than that in many other spheres, and four years ago a great event occurred in which (for reasons they never entirely understood) large swathes of the dung beetle population lost their access to dung-rolling opportunities and therefore faced ruin. One might imagine that the value of Dave's dungpile would thus have increased, but in fact the opposite occurred. In order to save the population, the king dung beetle arranged for some cows to drop more pats all around the field. There was suddenly free dung for everyone, and Dave watched in horror as his little stash started to erode in worth compared to that of all the other dung beetles.

Labels:

allegory,

dung,

dung beetle,

salt

On gold's intrinsic value

"The reason high[er gold] prices [haven't mobilised] above ground supply is because gold is monetary. There is not other commodity that behaves in this manner. Any commodity with around 60 years of annual new supply above ground would have a price close to zero." -Bron Suchecki

Gold has intrinsic value, but in a way that's not intuitively obvious. First, let's be clear that nothing really has value in itself, apart from what evolutionary forces have conferred upon it (or more precisely, conferred upon an organism's psychology) to better assist its survival and reproduction. So, a bucket of shit has no value (intrinsic or otherwise) to us, but a dung beetle would fight to the death over it. Similarly, sex is fun for all sentient organisms precisely because those who don't find sex pleasurable are likely to be weeded out of the gene pool. In this way, I think the way humans instinctively regard gold as valuable has to be an evolved trait. (You can say we like it because, e.g. it is shiny, but that begs the question: why do we like shininess?) Remember: human evolution, especially psychology/personality evolution, is surprisingly fast.

Any human in history and prehistory who didn't value gold would be at a competitive disadvantage, while those that really dug the stuff (literally and figuratively) would be selected for. (There could be group selection at work here too, a phenomenon whose nonexistence has been exaggerated).

Of course humans are a very malleable species. In North Korea, for example, you have arguably the highest IQ population in the world shedding tears over the death of a cruel and chinless midget. So, just as in Sweden they're trying to make urinating standing up illegal (this is true; it's apparently sexist that men get urinals), so in the Western world we've been inundated with propaganda that gold is a thing of the past, replaced by green linen. True, these cultural engineering experiments sometimes work to completion, but I have my money on human nature winning out in the end.

Only 3 charts this week. Silver closed at its lowest weekly point since November 2010. (Really!) I vowed not to trade silver back on May 6 (with the elegant proclamation that "the charts smell like farts"). (Don't ask me why I didn't short. I don't like shorting the metals, though I'm more likely to do so when they look "too" good than when they look bad, since I think they are likely manipulated to look bad right before they explode to the upside). This log chart looks headed to $22-23 (I was too lazy to include the linear chart from last week, where I circled the same point). That said, I am skeptical when the charts look this bad in such an obvious bull market. I would be surprised if silver can be pushed that far. But that's what the charts is saying.

With gold, I'm also waiting for the 144-day/ purple channel to be cleared. Limited return to risk shorting from here, and no need to try to be a hero and come in at the bottom. I'll wait.

Though the brown channel on my monthly chart (coincident with the 21-month MA at $1569) continues to be solid support:

Will The Real Fraud Please Stand Up?

Jeanne D'Arc successfully typecast me as being the philospher here, here's an update on my investigation of the metals markets.

Last week, the Wynter Benton copywriters appear to have taken on a new project by taking on the guise of 'ANOTHER', infiltrating the FOFOA comments thread. Unfortunately for them, FOFOA is pretty sharp, recognising their true colors from the very start, and quickly sent him packing . Regardless of the motivations or intent of the FakeAnother, the imposter followed a pattern common to most cons:

"The identity of your Big Trader matters not, do not concern yourself with speculation of events past. It was China! and it still is China. PAGE, the backdoor into the Treasury and now the LME. Yes, China holds a very strong hand and it grows stronger." [link]

The key to the imposter identification is the brush-offs regarding any authentication challenge. I won't go into it because it's yesterday's news already but for a while I wallowed in the beautiful ironic possibility that perhaps ANOTHER had broken his long silence and was chased away by the faithful. There is also still the chance that ANOTHER was an early Wynter Benton, but I won't advance that concept for obvious reasons (only to say that I'm intrigued by the possibility at a philosophical level). The trouble for anyone wanting to debunk the freegold thesis is that they must debunk a large body of resesarch which (to date) has generally held up against much scrutiny.

I don't think Martin Armstrong succeeded in debunking freegold theory. Many folk (including myself) have been writing Martin to get him to investigate the Freegold thesis, simply to see if the concept has merit in the context of his economical understanding. His recent essay titled 'The Truth About Gold & Why You Should Buy It!' disappointed me in general (pdf version). Originally I tuned out long before page 19, but Kid Dynamite made me take another look.

Last week, the Wynter Benton copywriters appear to have taken on a new project by taking on the guise of 'ANOTHER', infiltrating the FOFOA comments thread. Unfortunately for them, FOFOA is pretty sharp, recognising their true colors from the very start, and quickly sent him packing . Regardless of the motivations or intent of the FakeAnother, the imposter followed a pattern common to most cons:

- Locate a group of people and identify their area of interest.

- Establish some form of credibility (real or imagined), using any available technique.

- Refuse verification and discussion of key topics, using various run-arounds or ambiguity.

- Inject an ideas stream using credibility, while it lasts.

"The identity of your Big Trader matters not, do not concern yourself with speculation of events past. It was China! and it still is China. PAGE, the backdoor into the Treasury and now the LME. Yes, China holds a very strong hand and it grows stronger." [link]

The key to the imposter identification is the brush-offs regarding any authentication challenge. I won't go into it because it's yesterday's news already but for a while I wallowed in the beautiful ironic possibility that perhaps ANOTHER had broken his long silence and was chased away by the faithful. There is also still the chance that ANOTHER was an early Wynter Benton, but I won't advance that concept for obvious reasons (only to say that I'm intrigued by the possibility at a philosophical level). The trouble for anyone wanting to debunk the freegold thesis is that they must debunk a large body of resesarch which (to date) has generally held up against much scrutiny.

I don't think Martin Armstrong succeeded in debunking freegold theory. Many folk (including myself) have been writing Martin to get him to investigate the Freegold thesis, simply to see if the concept has merit in the context of his economical understanding. His recent essay titled 'The Truth About Gold & Why You Should Buy It!' disappointed me in general (pdf version). Originally I tuned out long before page 19, but Kid Dynamite made me take another look.

Labels:

Another,

Armstrong,

Fraud,

Wynter Benton

Sunday pre-game 6/17

As I've mentioned over the past few months, I haven't been following the PMs too closely lately, though I've tried to keep postings as current as possible. Charts are great for analyzing relatively free markets. As in lots of individuals on both the supply side and the demand side, all looking out for their own interests, leading to emergent patterns in prices, sometimes providing hints of probabilities of future outcomes. In current markets, we indeed have players looking out for their own interests, but unfortunately, they are juggernauts with so much power to drive things their way, so much more information to know what will happen in advance, and, most importantly, almost complete impunity from being held responsible for their malfeasnace, that we might as well be the diddlyshits in Rome waiting for the Council of Cardinals to release smoke signals reflecting their choice of Pope (except that the smoke signals were generally not released to fool us into panicking so that our pockets could be better picked). A priori, the shenanigans can be expected to be especially egregious in the PM markets, insofar as PMs are a natural replacement for the fiat regime that has so enriched the undeserving scum that defend it. PM investors look at the sickness around them and conclude that this can't possibly last. But that may or may not be true. Adam Smith's quote, "There's a lot of ruin in a nation," may be apropos here. Remember, the first rule of good parasitism is to keep your host alive and relatively functional.

LME buyout

HONG KONG (AP) — Hong Kong's stock exchange operator said Friday it has agreed to buy the 135-year-old London Metal Exchange for 1.4 billion pounds ($2.2 billion) as it shifts into commodities to capitalize on Chinese demand.

Hong Kong Exchanges and Clearing Ltd. said it has signed an agreement with the LME, the world's largest metals market, to pay 107.60 pounds for each of its 12.9 million shares. The LME's board plans to recommend shareholders accept the offer at a meeting expected before the end of July.

The Hong Kong bourse's offer follows plans announced earlier this year to expand into commodities, marking a major move away from its slow-growing equities business.

Hong Kong Exchanges said the LME has yet to "realize fully the growth opportunity" in Asia, especially China, and the deal would provide a platform for "significant revenue growth" as LME expands its business and operations in the region.

Though the LME already accounts for 80 percent of global trading in nonferrous metals, "it really has a tremendous amount of room to grow in Asia," said Hong Kong Exchange CEO Charles Li.

China, the world's second biggest economy, has a near insatiable appetite for metals, fueled by its booming economy's demand for everything from cars to computers to skyscrapers. The country accounts for 42 percent of global consumption of nonferrous metals like aluminum, copper, nickel and zinc.

The deal would give China more power in influencing how metal prices are set in global trading. At the moment, capital controls and other issues mean that "even though China is such a big consumer they don't play as much a role as they should" in setting prices on the LME, Li said.

The deal would also give Chinese companies more access to futures contracts so they can hedge their risk, Li said.

Li said the Hong Kong exchange could use the LME to expand into dealing in other metals like iron ore and steelmaking coal, which are "very, very massively needed in China," as well as other commodity types.

The LME purchase would also allow the exchange to develop products denominated in yuan, China's currency, which China is trying to promote greater use of abroad. Li said yuan commodity contracts would "strongly accelerate" outflows of the currency to Hong Kong, a semiautonomous region of China with its own currency and legal system that is being positioned as a hub for offshore yuan trading.

The LME hosts trading of futures and options contracts worth, on average, $61 billion a day or $15.4 trillion annually. It's the last open-outcry exchange in Europe, where deals are made by traders huddling together on a trading floor and calling out prices, rather than electronically.

The LME also operates 732 warehouses in 14 countries to store the actual metal that backs the contracts traded on its market. A deal with the Hong Kong exchange would pave the way to bring storage sites in China into its network.

The Hong Kong exchange will use cash and new bank facilities of at least 1.1 billion pounds to finance the purchase.

The takeover also needs approval from Hong Kong Exchange's shareholders and British regulators. It's expected to close in the fourth quarter of 2012.

Sunday pre-game, 6/10/2012

This post will be brief, as I am tending to unforeseen developments regarding my coal cellar. Let's face it, coal cellars don't take care of themselves, and poor morale and absenteeism in one's workforce don't help. I have given up on one especially delinquent employee, who shall go unnamed. However, I have found a suitable replacement:

This post will be brief, as I am tending to unforeseen developments regarding my coal cellar. Let's face it, coal cellars don't take care of themselves, and poor morale and absenteeism in one's workforce don't help. I have given up on one especially delinquent employee, who shall go unnamed. However, I have found a suitable replacement:Jeanne d'Arc Escapes From the Cellar

Hello, loyal readers of Screwtape. Sorry about my absence for the last month. I will give you three excuses, and you can decide for yourselves which, if any, of them are true. The first is that Her Majesty unexpectedly called upon me to represent her in a West African conflict zone, and I have needed to spend the last few weeks learning Bambara, improving my Walther-PPK handling, and brushing up on Land Rover maintenance.

Hello, loyal readers of Screwtape. Sorry about my absence for the last month. I will give you three excuses, and you can decide for yourselves which, if any, of them are true. The first is that Her Majesty unexpectedly called upon me to represent her in a West African conflict zone, and I have needed to spend the last few weeks learning Bambara, improving my Walther-PPK handling, and brushing up on Land Rover maintenance.The second is that I made GM Jenkins very, very cross indeed, and - for my own good, might I add - needed to spend a while in his coal cellar reflecting on my general attitude towards the silverogosphere, my bloggers-in-arms on other sites, and the over-rated value of sarcasm in a civilised world.

The third is that GM, Warren and I have been too busy preparing for Bilderberg, which we regularly attend as confirmed members of the Illuminati. This year has been especially pressing, given the coming financial apocalypse and all, and it's taken more time out of our busy schedules of whoring, renovating houses and hacking tax records (respectively) than we might otherwise have liked.

You pays your money, and you takes your chances. Anyway, I'm now back, and I'm ready to pwn the kidz like a boss [sorry - I don't know what happened to my more usually conservative diction there...]

Labels:

bonds,

Gold,

gold miners,

Quantitative Cheesing III,

silverogosphere,

USD

Monthly metals re-cap, 5/31

I just wrote up a weekly metals recap thinking today was Friday. In my defense, heavy drinking has been shown to reduce the integrity of white matter, the brain's highways that communicate neuron messaging. But on top of that, the financial markets have been incredibly boring of late (not that there's not a lot of interesting stuff going on, just that it's all going on behind the scenes).

Well at any rate it *is* the end of the month. Seems like yesterday I posted the monthly gold chart and mentioned we had completed an unprecedented third red month in a row. That was April, now we add May for a total of four consecutive red months and counting. What a bullish development for anyone afraid gold was getting ahead of itself.

Well at any rate it *is* the end of the month. Seems like yesterday I posted the monthly gold chart and mentioned we had completed an unprecedented third red month in a row. That was April, now we add May for a total of four consecutive red months and counting. What a bullish development for anyone afraid gold was getting ahead of itself.

My gold and silver predictions from a month ago ($1550 and $27.50) have held quite well, though there have been a few quick spikes lower. Note the 21-month MA on the monthly chart above, which was among the main sources of my predictions.

I've also been looking at the CCI(50) indicator, and noticed that whenever gold fell into the red zone below, that never marked a rally-preceding bottom (as when sharp drops in the indicator didn't quite make it to the red zone): there was always another shoe to drop (at least another scare, even if a lower low wasn't made). Well you'll note that's exactly what happened, so now I'm waiting for the CCI(50) to get back over -100.

Here's the $GOLD:$CRB index from last post, which was discussed a bit in the comments. Breakout? A few more up days, and it will certainly start looking like the next big move for gold as a safe haven is upon us.

Also check this one out, suggested by victor_the_cleaner. Also at an all-time high!

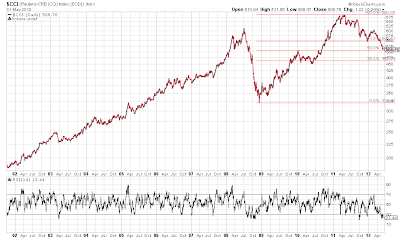

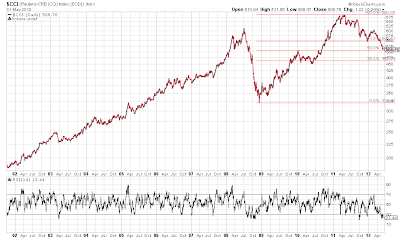

Then there's the $CCI commodities index, which is hitting the $506 level that I warned about a month ago, when it was at $542 ("the $506 level, at the 50% retracement, looks like a good time for a QE3 announcement.") If QE3 is indeed soon announced, and the $CCI jumps, then I deserve to be crowned and hailed as a grandmaster of prognostication by the governing body of mildly innumerate chartists forgetful of all my bad predictions.

Then there's the $CCI commodities index, which is hitting the $506 level that I warned about a month ago, when it was at $542 ("the $506 level, at the 50% retracement, looks like a good time for a QE3 announcement.") If QE3 is indeed soon announced, and the $CCI jumps, then I deserve to be crowned and hailed as a grandmaster of prognostication by the governing body of mildly innumerate chartists forgetful of all my bad predictions.

|

| Finally, the "10 yr yields in silver" chart, which still looks ready to drop precipitously to me ... despite all-time low yields. |

Subscribe to:

Posts (Atom)